U.S. Stock Futures Plunge as Trump Signals 70% Tariffs: What Investors Need to Know

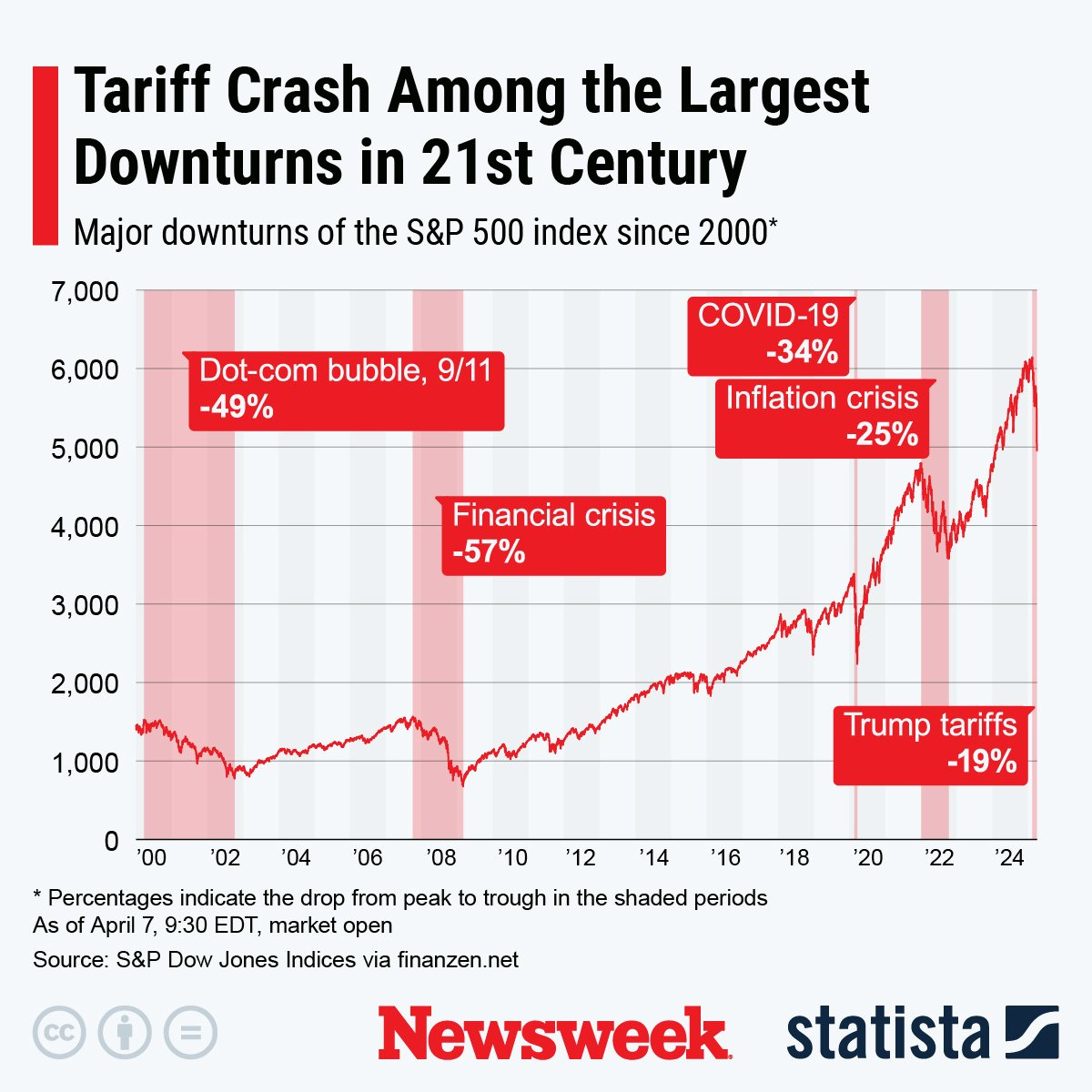

U.S. stock futures dropped sharply after President Trump hinted at tariffs as high as 70%. Discover the market impact, investor reactions, and what this means for global trade and your portfolio.

Introduction

U.S. stock futures experienced a significant downturn after President Donald Trump announced plans to impose tariffs as high as 70% on certain imports. This unexpected move sent shockwaves through global financial markets, raising concerns about a renewed trade war and its potential impact on the economy. In this article, we’ll break down what happened, why it matters, and how investors can navigate the uncertainty.

What Triggered the Sell-Off?

On Friday, President Trump revealed that his administration would begin sending out letters to various countries, notifying them of new tariffs that could reach up to 70%. The announcement came while U.S. markets were closed for the July 4 holiday, but futures tied to major indices reacted immediately:

Dow Jones Industrial Average futures dropped 251 points (0.56%)

S&P 500 futures fell 0.64%

Nasdaq futures declined 0.68%

Trump stated that about “10 or 12” countries would receive tariff notifications, with more to follow in the coming days. The new rates are set to take effect on August 1, with tariffs ranging from 10% to 70% depending on the country and product.

Market Reaction: A Snapshot

The market’s response was swift and severe:

Stock Index Futures: All major U.S. stock index futures tumbled, signaling a rough open for Wall Street.

Oil Prices: U.S. oil prices slipped 0.75% to $66.50 per barrel, while Brent crude lost 0.41% to $68.52.

Gold: Investors flocked to safe-haven assets, pushing gold up 0.11% to $3,346.70 per ounce.

Currency Markets: The U.S. dollar fell 0.16% against the euro and 0.30% against the yen.

Why Are Tariffs So Disruptive?

Tariffs act as a tax on imported goods, making them more expensive for consumers and businesses. When tariffs are imposed at such high levels, they can:

Increase costs for manufacturers and retailers

Reduce profit margins for companies reliant on global supply chains

Trigger retaliatory measures from other countries, escalating trade tensions

Slow down global economic growth by disrupting trade flows

The mere hint of 70% tariffs is enough to spook investors, as it signals a potential escalation in the ongoing trade war and raises the risk of a global recession.

Sectors Most at Risk

Certain sectors are particularly vulnerable to higher tariffs:

| Sector | Impact of Tariffs | Example Companies |

|---|---|---|

| Technology | Higher component costs | Apple, Tesla |

| Retail | Increased import prices | Walmart, Dollar Tree |

| Manufacturing | Supply chain disruption | Caterpillar, Ford |

| Consumer Electronics | Price hikes, lower sales | Samsung, Sony |

Companies with significant overseas manufacturing or global supply chains are likely to feel the brunt of these tariffs, as seen in previous rounds of trade tensions.

Global Ripple Effects

The impact of Trump’s tariff announcement isn’t limited to the U.S. Global markets also reacted:

Asian and European stocks saw declines as investors braced for a potential slowdown in global trade.

Emerging markets faced additional pressure due to currency volatility and concerns over export demand.

Commodities like oil and metals dropped on fears of reduced industrial activity worldwide.

Investor Sentiment and Safe Havens

Whenever trade tensions flare, investors tend to seek safety in assets like gold, U.S. Treasuries, and the Japanese yen. The latest tariff threat was no exception, with gold prices edging higher and the dollar weakening against other major currencies.

What’s Next? Key Dates and Developments

Tariff Letters Sent: About 10-12 countries notified, with more to follow.

Tariffs Effective: August 1, 2025.

Potential Retaliation: Other countries may respond with their own tariffs, further escalating the trade war.

Investors should watch for official responses from major U.S. trading partners, as well as any signs of negotiation or compromise in the coming weeks.

How Should Investors Respond?

Stay Informed: Monitor news from reliable financial sources for updates on tariffs and market reactions.

Diversify Portfolios: Spread investments across sectors and geographies to reduce risk.

Focus on Fundamentals: Look for companies with strong balance sheets and limited exposure to global supply chains.

Consider Safe Havens: Allocate a portion of your portfolio to assets like gold or government bonds during periods of high volatility.

Avoid Panic Selling: Market downturns can create opportunities for long-term investors. Stay calm and review your investment strategy before making major moves.

Conclusion

President Trump’s hint at imposing tariffs as high as 70% has rattled U.S. stock futures and global markets, raising fears of a renewed trade war and economic slowdown. While the full impact remains to be seen, investors should brace for continued volatility and focus on strategies that can weather the storm. Staying informed, diversifying, and maintaining a long-term perspective are key to navigating these uncertain times.