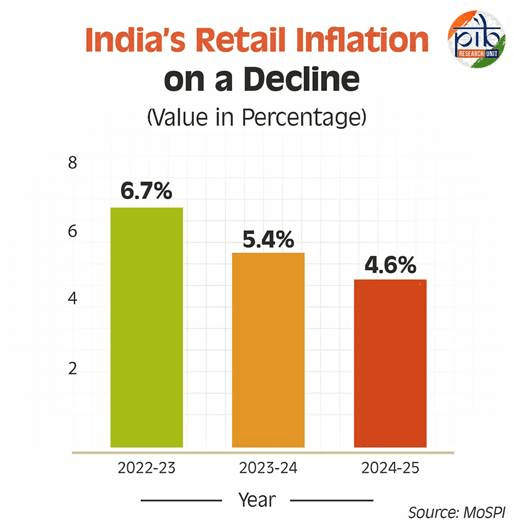

India’s Retail Inflation Falls to 8-Year Low in 2025 — Key Reasons Behind the Dramatic Decline

India’s 'retail inflation' has dropped to its lowest level since 2017, driven by falling food prices and easing cost pressures. Uncover the main factors behind this surprising development and its impact on the Indian economy in 2025.

India’s Retail Inflation Hits Lowest Since 2017 — What’s Driving the Unexpected Drop?

India has just witnessed an economic milestone as retail inflation touched its lowest point in over eight years, sparking widespread attention from analysts, policymakers, and consumers alike.

India’s Retail Inflation Falls to 8-Year Low in 2025

In September 2025, the country’s retail inflation rate plummeted to 1.54%, slipping below the Reserve Bank of India’s (RBI) lower target band and revealing several important trends about the nation’s financial health. This article explores the main forces behind this dramatic dip, its deeper implications, and what it means for the broader Indian economy.

Understanding the Numbers: The 2025 Inflation Snapshot

According to the Ministry of Statistics and Programme Implementation, India’s consumer price index (CPI)-based retail inflation dropped to 1.54% in September 2025, sharply down from 2.07% in August and marking the lowest level since June 2017.

This drop is not just a statistical blip — it is a reflection of consistent, sector-wide softening in prices over recent months.

The Consumer Food Price Index (CFPI) even entered negative territory, registering a notable -2.28% in September, compared with -0.64% in August.

Urban and rural inflation rates stood at 2.04% and 1.07% respectively, highlighting that this trend is broad-based across locations.

What’s Driving This Record Low Inflation?

The recent plunge in India’s retail inflation can be attributed to a confluence of several key drivers:

Sustained Drop in Food Prices: The single biggest factor in the inflation drop has been an ongoing fall in food prices, particularly vegetables. Since April, prices of staple vegetables have declined by double digits, creating significant negative inflation in the food segment.

Edible oils, pulses, and cereals have also become cheaper over the past quarter.

Favourable Monsoon and Base Effect: A favorable base effect — where last year’s high prices exaggerate the year-on-year decline — has accentuated the pullback in inflation numbers.

Consistent monsoon patterns have led to surplus agricultural production, moderating prices further.

Global Commodity Pressure Easing: After witnessing global food and fuel price shocks in previous years, international commodity prices stabilized, lessening imported inflation in India.

GST Rationalisation and Government Policy: Key government interventions, such as the GST rate rationalization on essential goods, have helped curb price rises. Policy reforms have aimed to streamline supply chains and control price spikes in vital sectors.

How Did RBI Respond?

For the second time within this quarter, India’s inflation has slipped below the RBI’s target band of 2-6%.

This gives the central bank added headroom to consider a rate cut in December, especially since inflation has now remained consistently subdued for consecutive months.

In the current year, the RBI had already lowered interest rates by 100 basis points, choosing to hold policy rates steady at 5.5% in October but signaling flexibility for further easing if inflation stays benign.

Impact on Households and the Broader Economy

A notable easing of inflation is a source of relief for Indian households, who have grappled with soaring prices over the past couple of years. Lower inflation effectively increases disposable income, improving the purchasing power of consumers.

For policy-makers, it signals room to support growth, investments, and job creation, with less concern about runaway price increases.

Retail sectors, including FMCG and consumer durables, have reported marginal upticks in sales, as households feel confident to spend more when everyday costs are under check.

Will This Deflationary Trend Sustain?

While the current scenario is encouraging, economists caution against complacency. Factors like excess rainfall or unexpected supply disruptions could impact future harvests and reverse the downward trend, especially in the food basket.

Global uncertainties, commodity price fluctuations, and any future fiscal measures will also play important roles in shaping inflation over the next 6-12 months.

Conclusion: A Turning Point for India’s Economy?

India’s record-low retail inflation in 2025 is the outcome of a rare convergence of favorable domestic and international trends — steady agricultural output, controlled supply chains, softening commodity prices, and targeted policy interventions.

As the RBI weighs further interest rate changes and households benefit from greater purchasing power, this development could mark a turning point for India’s post-pandemic economic momentum.