Post Office Scheme Calculator: Invest Rs 12,500 Monthly & Earn Rs 40 Lakh Safely

how to use the "Post Office Scheme" Calculator to grow your monthly savings. Learn how investing Rs 12,500 per month can build a safe corpus of Rs 40 lakh with guaranteed returns.

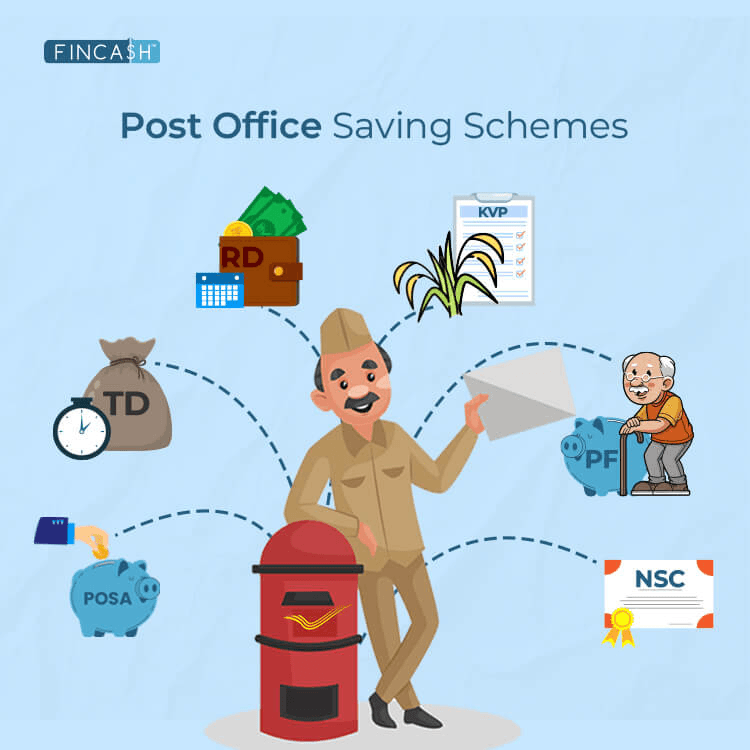

Understanding Post Office Saving Schemes

The India Post has introduced a wide range of small saving schemes backed by the Government of India. These schemes are not just secure but also guarantee steady returns, which makes them one of the most reliable investment options for middle-class families, senior citizens, and risk-averse investors.

Post Office Scheme Calculator: Invest Rs 12,500 Monthly

For those who want to calculate long-term benefits, the Post Office Scheme Calculator is a useful tool that helps estimate maturity value, monthly returns, and total corpus built over a fixed tenure.

An interesting strategy is investing a fixed monthly amount that compounds into a large sum.

For example, if you start investing Rs 12,500 per month in certain Post Office schemes, your savings could grow up to Rs 40 lakh at maturity.

How Does the Post Office Scheme Calculator Work?

The Post Office Scheme Calculator uses three main inputs:

Monthly or yearly contribution

Interest rate applicable under the selected scheme

Investment tenure (number of years you plan to invest)

Once these values are added, the calculator immediately projects your maturity amount and interest earned.

It is especially helpful when tracking returns under schemes such as Recurring Deposit (RD), Public Provident Fund (PPF), or National Savings Certificates (NSC).

For example, if you contribute Rs 12,500 each month into a scheme with an average annual return of around 7% over multiple years, your maturity sum approaches Rs 40 lakh.

This is a disciplined saving strategy where consistent monthly investments turn into long-term wealth.

Popular Post Office Schemes to Build Rs 40 Lakh

Post Office Recurring Deposit (RD)

Minimum investment: Rs 100 per month

Tenure: 5 years (can be extended)

Current rate: approx. 6.7% annually

Best suited for salaried individuals looking for monthly deposits

If you maintain long-term discipline by renewing your RD and reinvesting, you can work toward the Rs 40 lakh mark over time.

Public Provident Fund (PPF)

Minimum investment: Rs 500 annually

Maximum: Rs 1.5 lakh annually under Section 80C tax exemption

Tenure: 15 years (can extend in blocks of 5 years)

Current rate: approx. 7.1% annually

A consistent monthly PPF deposit of Rs 12,500 can yield extremely high maturity values over 15 years.

National Savings Certificate (NSC)

Lock-in: 5 years

Interest compounded annually but paid on maturity

Secure investment for long-term goals

If invested systematically, NSCs also contribute to wealth accumulation with guaranteed safety.

Example Calculation: Rs 12,500 Monthly Investment

Suppose you invest Rs 12,500 each month for 20 years in a scheme offering an average of 7% annual return.

The maturity amount (A) of a recurring investment under compound interest can be estimated as:

A=P×(1+r/n)n×t−1r/nA=P×r/n(1+r/n)n×t−1

Where:

PP = monthly contribution (Rs 12,500)

rr = annual interest rate (7% or 0.07)

nn = compounding frequency (12 for monthly)

tt = investment tenure in years (20 years)

Using this formula, the maturity value comes close to Rs 40 lakh, including both principal and interest earned.

This shows the sheer power of disciplined investing through Post Office schemes.

Why Post Office Schemes Are Safe Investments

Backed by the Government of India

Steady interest rates that rarely fluctuate

Easy to access through nationwide Post Office branches

No risk of market volatility

Tax-saving benefits under certain schemes (e.g., PPF, NSC)

For conservative investors who prioritize safety over risky stock markets, these schemes remain a cornerstone of financial planning.

Tips to Maximize Your Returns

Start investing early to get the benefit of compounding.

Use the Post Office Scheme Calculator regularly to track your savings growth.

Diversify across different Post Office products for liquidity and higher maturity values.

Reinvest matured deposits into fresh schemes to continue compounding wealth.

Use tax deductions under Section 80C for eligible schemes.

Final Thoughts

The Post Office Scheme Calculator is a powerful tool for middle-class families and individuals aiming for financial security.

By investing Rs 12,500 per month, it is indeed possible to build a retirement or emergency corpus of nearly Rs 40 lakh without any exposure to stock market risks.